I’ve talked a lot about buying cash cars. I have said most people can’t afford the depreciation that comes with buying a new car. and cautioned about buying one on credit. I will tell you a cautionary tale of my own new car experience and the lessons I learned from it.

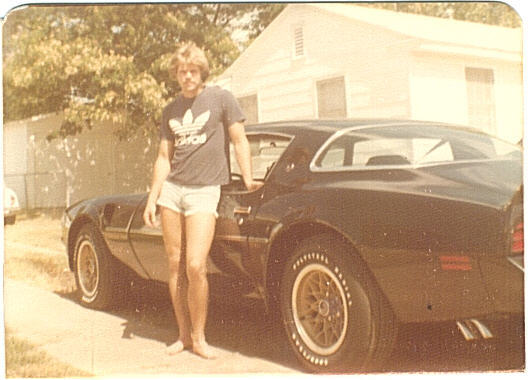

When I was 21 years old, I just had to have a new car and not just any new car, I had to have a Pontiac Trans Am. Not just any Trans Am, but a Trans Am with the High Performance package and a Hurst 4 speed.

Click to Listen

Podcast: Play in new window | Download

At the time I was making $8500 a year or about $700 a month working in a warehouse. Did this stop me from buying a new car for $8300? No!

Both of these numbers would be between 28 and 29,000 in 2013 dollar to put them in more current perspective.

Now, it is worth noting even those who believe in buying on credit only recommend buying a car that 20% of your monthly income. That would have allowed me to buy about a $5,000 car.

I was living at home with mom and dad, so, I figured it didn’t matter how much of my money went to my car. After all, I didn’t have a plan for moving out. Besides, it was a black on black Trans Am with a big gold bird on the hood, right? I just knew it would make me cool.

So, I bought my new car and started with four years of car payments at $244/mo, which was 34% of my monthly income. I don’t remember my exact interest rate at the time. Prime was about 11% and I had no credit, so it had to be fairly high. I had never purchased car insurance either and didn’t know an agent. I financed the insurance in with the car. This was not at all smart, as you will see later.

The same year I bought my new car there was an oil crisis and gas shot from about $0.60 a gallon to about $1.60. This was big a hit for me, as my Trans Am got about 12 miles to the gallon in town and about 14 on the highway. I figure while I owned this car gas cost me between $1,400 and $1600 a year.

My dream car quickly became a nightmare that lasted over the next two plus years.

From very nearly day one it had a starting problem that the dealership never could figure out. If I had been more sophisticated or wise, I might have tried to return the car and demand my money back when they couldn’t fix the problem, but that didn’t happen.

Sometimes it would not start and I would have to get a jump start on my brand new car just to get home. It took about 18 months to find the solution to this problem. It was solved by local tune up shop who discovered a broken wire under the distributor cap. When the battery was a little low on charge, the spark couldn’t jump between the wires and allow the car to start.

American car quality was not at an all time high in 1978.

At the end of year one, I received a notice that I needed to get more insurance for year two of my car loan. This caught me off guard, as I thought four years of insurance had been priced in (obviously I didn’t read the contract). I did nothing about the notice, which led to about a $30 increase in my payment as insurance was again added to my loan. So, I was now paying $274/month in year two. In year three the same thing happened and my payments went to about $311/month.

I know how stupid my decisions were and how much it cost me. At the time, though, I was so naive and I didn’t ask anyone for help. I was too embarrassed.

As I prepared to sale the car, car payments and insurance for the 27 months of ownership put me out $7149. I sold the car for about $3400 and was glad to see it go.

This new car purchase was a costly lesson for me, but one I learned well.

I have not owned a new car since.

Here are my major takeaways from this experience.

- Don’t let someone else tell you how much car you can afford

- Pay for any warranty or insurance separately. Never roll it into a loan

- Think about the total cost of ownership not just the purchase price, think about things like insurance, gas milage, repairs, and maintenance

- Warranties are only as good at the the dealership or manufacturer behind them.

I have made many other mistakes buying and selling cars since then, but I never bought another new car for myself.

I hope my experience will help you avoid a similar experience.

Links:

Website: http://www.cashcarconvert.com

If you liked this episode, please consider going to iTunes and subscribing . On iTunes once you subscribe, you can leave a rating and review. Taking this action will help this podcast move up and be more easily found in iTunes. Thank you for an honest rating and review.

Alternatively, you can let me know on Twitter at @CashCarConvert

Do you have a comment about this interview or about the podcast itself? Please leave a comment below.

I appreciate every listener. Thank you for listening to the Cash Car Convert podcast.

Please note: I reserve the right to delete comments that are offensive or off-topic.